Morning Mint Newsletter

Date: January 18, 2025

On Friday, Nifty50 closed at 23203. Nifty remained dull after the morning session and traded in a tight range below 23265.

Nifty will continue to be under pressure until and unless Nifty could strongly break above 23350.

On the other hand, Bank Nifty was dragged down on Friday because of weak results of Axis Bank and in anticipation of more weak results coming. Bank Nifty closed 48540.

Top Headlines of the Week

- Rupee Depreciation Continues:

- The Indian Rupee saw further depreciation amid global economic uncertainties. USD INR stands at around 86.55.

- Potential discussions about the 8th Pay Commission and its impact on government expenditure are in focus.

- US sanctions on oil exports stirred the global energy market, adding pressure to developing economies like India.

- Foreign Portfolio Investors (FPIs) Exit Indian Markets:

- FPIs have sold Rs. 33,181 crore in the past eleven sessions, maintaining their stance as net sellers.

- Global market volatility and tightening monetary policies in advanced economies appear to be key factors.

- SEBI Pushes for Greater Transparency in Mutual Funds:

- SEBI has instructed mutual funds to disclose the information ratio of schemes to investors.

- This move aims to improve transparency and help investors make better decisions based on scheme performance.

Markets and Finance

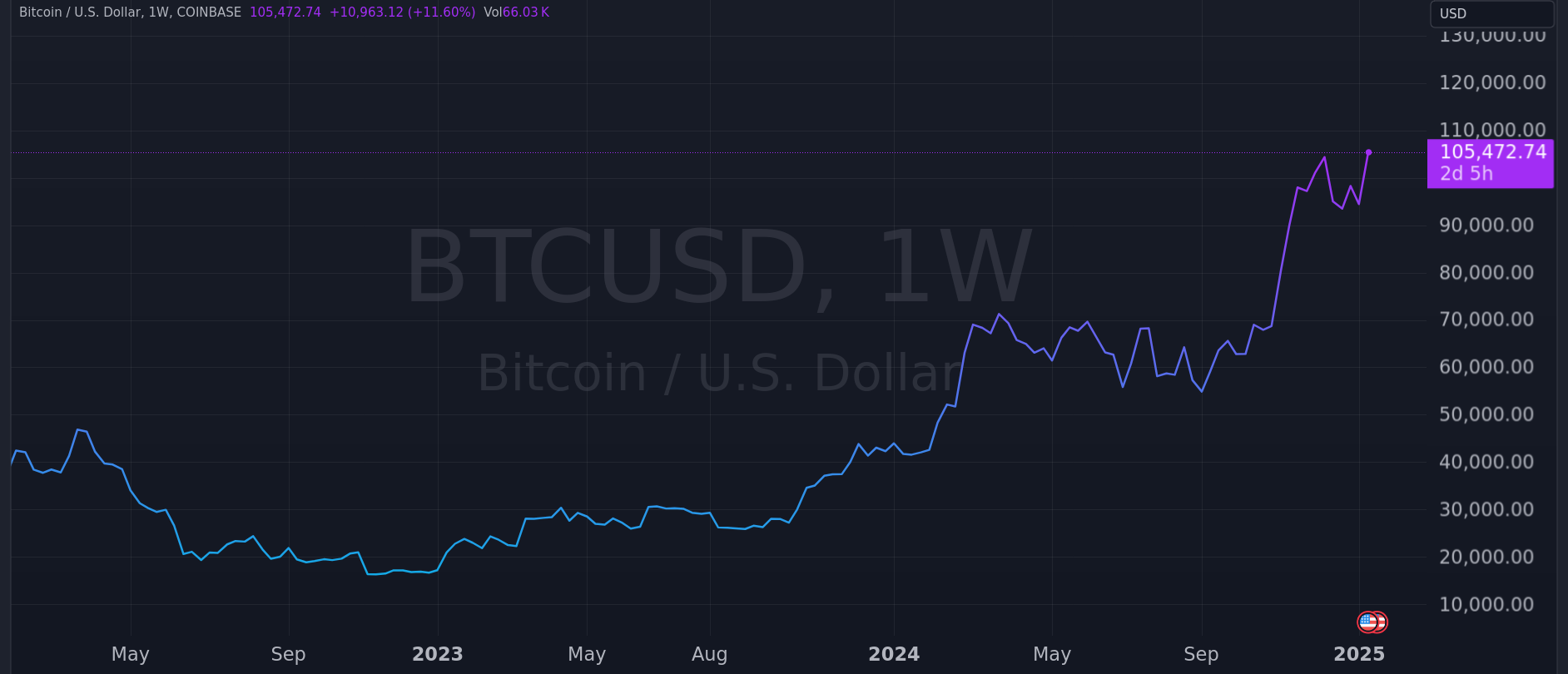

- Cryptocurrency Surges:

- Bitcoin prices soared past $100,000 this week, driven by speculation of early action on crypto regulation by former US President Donald Trump.

- Experts suggest heightened market interest in digital assets despite regulatory uncertainties.

- Corporate Earnings:

- Wipro:

- Reported a 4.5% quarter-on-quarter (QoQ) rise in net profit to Rs. 3,354 crore in Q3 FY25.

- The company outperformed market expectations, reflecting strong operational performance.

- SBI Life Insurance:

- Posted a 71% jump in net profit for Q3, reaching Rs. 550.82 crore.

- The surge is attributed to higher premium income and effective cost management.

- Wipro:

What to Watch This Week

- Impact of US Oil Sanctions:

- Analysts are closely monitoring how sanctions on oil exports will affect crude prices and India’s import bill.

- Investor Sentiment in Indian Markets:

- With continued FII selling, Indian equities may remain under pressure.

- Corporate Earnings Season:

- Results from key players in the banking and technology sectors will set the tone for market sentiment.

Zomato, Kotak Mahindra Bank, HDFC Bank, HUL, Persistent Systems, Coforge are expected to announce results in the next week.

- Results from key players in the banking and technology sectors will set the tone for market sentiment.

Quote of the Day: “Investing in knowledge always pays the best interest.” — Benjamin Franklin

Morning Mint Insights: Stay informed and make smart financial decisions. We’ll keep you updated with key trends and data every morning.

Join our newsletter mailing list here.

Have a great weekend!

Leave a Reply